defer capital gains tax canada

Because 50 of the gain must be included as income your taxable capital gain is 1500. It is possible to make a 1000 profit while also losing 500.

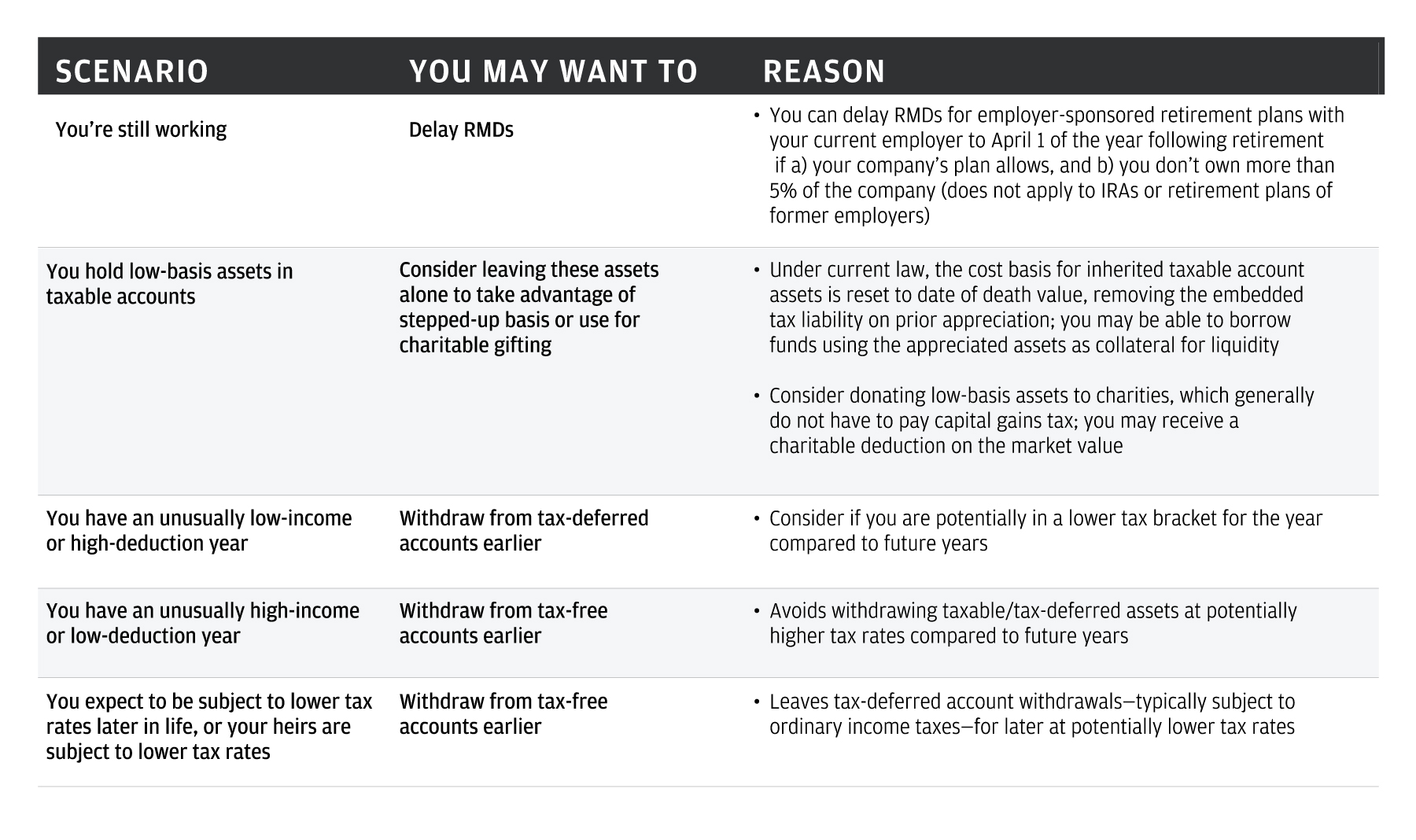

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

Defer Capital Gains Tax.

. Canada does not have capital gains tax. To encourage investment in these areas the IRS has created a program that allows investors to defer a certain amount of their capital gains taxes upon sale. What expenses can I offset against capital gains tax.

Here are six creative ways to defer a tax bill until a future year. In this case it is like you earned 1500 in income and this income will be taxed at. If you have more than.

In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. Your net gain after deducting the loss is 500 of which 250 must be. Section 44 applies to a property that.

The inclusion rate is 50 so you add half of that gain 558308 to your total income for the. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021. Capital gains realized by investors are currently subject to tax on only half of the gain.

The first is to become immortal and never sell your assets. There are three ways to completely avoid capital gainsall of which are either unrealistic or unappealing. 50000 20000 30000 long-term capital gains If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

The 1031 Exchange does allow you to defer the payment of taxes in the US but there is nothing that Im aware of in Canada. You deduct your exemption of 883384 to get a 1116616 taxable capital gain. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale.

Section 121 Primary Residence Exclusion Section 453 Installment Sale Section 1031 Like Kind Exchange Neve. This deferral applies to dispositions where you use. Whether realized corporately or personally capital gains currently have an effective tax.

Capital gains tax is not due in this scenario. Deferral election is not taken but can claim CCA Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly. The government revenues that would be deferred by the proposal in the first year after implementation are approximately the following.

You can deduct certain costs from taxable gains to reduce the Capital Gains Tax you pay on your property including. Claim a capital gains reserve. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares.

Federal Total ProvincialTerritorial Deferred.

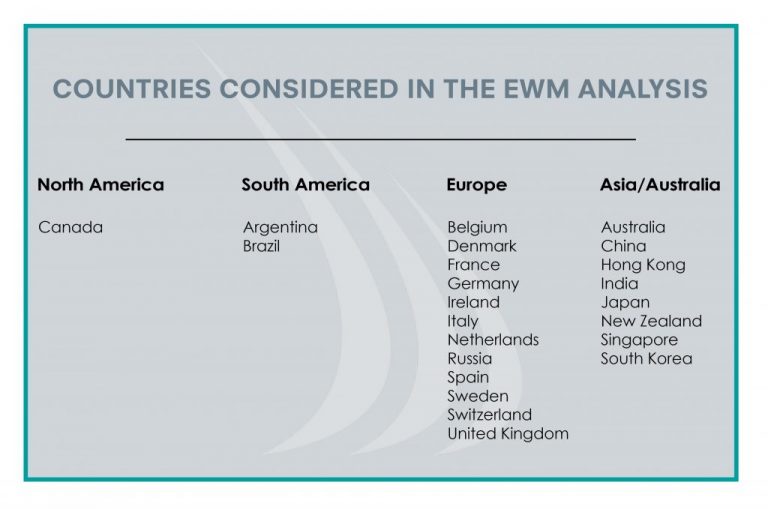

Voluntary Deferred Compensation Vdc Plans Outside The Us A 2019 Update Ewm Global Ewm

How Are Capital Gains Taxed Tax Policy Center

5 Categories Of Tax Planning Alitis Investment Counsel

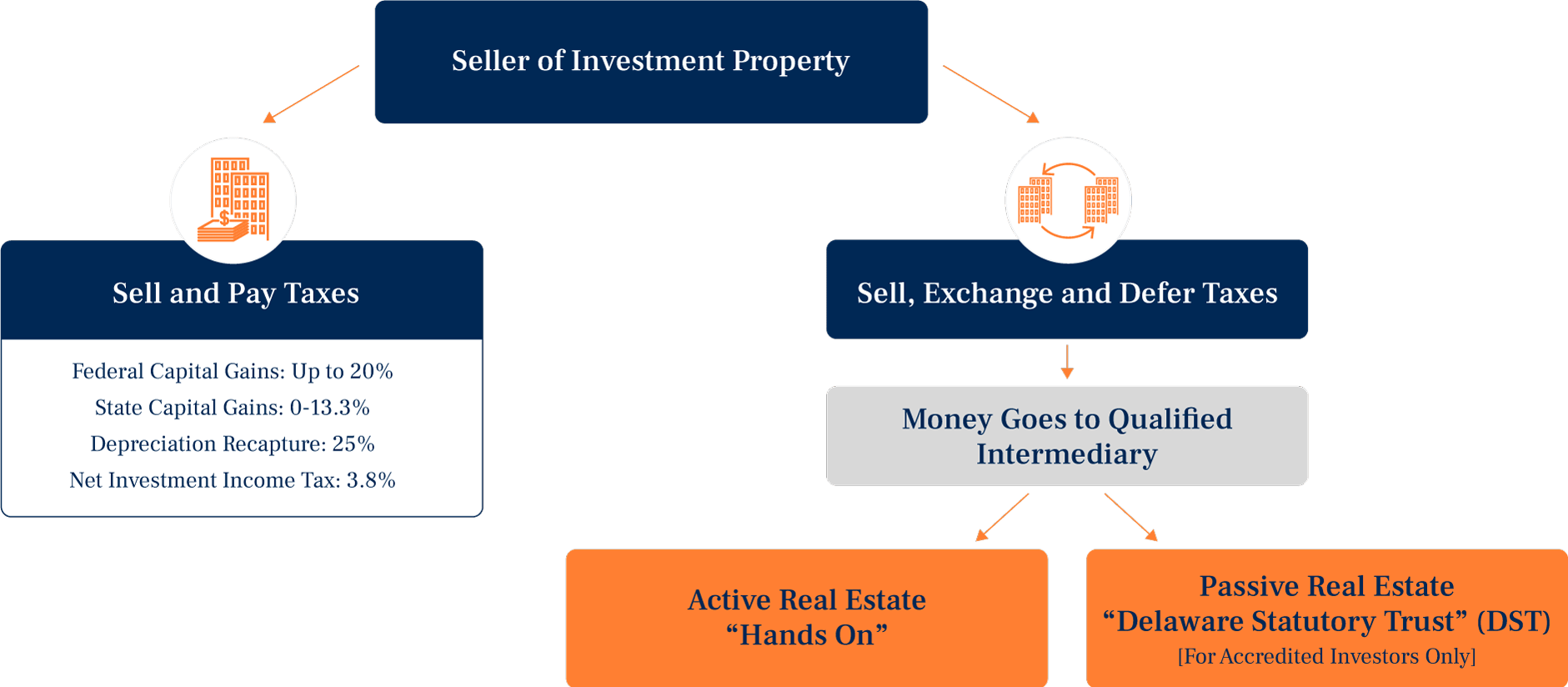

How To Defer Capital Gains Tax On Real Estate Sales Madan Ca

Should You Defer Capital Gains Taxes With A 1031 Exchange Cnet

Capital Gains Tax Calculator For Relative Value Investing

What Is Tax Gain Harvesting Charles Schwab

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How To Know If You Have To Pay Capital Gains Tax Experian

1031 Exchange Investment Properties Marcus Millichap

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How To Avoid Capital Gains Tax In Canada Remitbee

Capital Gains Tax Calculator For Relative Value Investing

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

How To Avoid Capital Gains Tax Personal Capital

Defer Capital Gains Tax When To Pay Taxes Manning Elliott

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Capital Gains Tax Cutting Down On Tax Payable When Selling Real Estate